TradingView Suite — The Integrated Ecosystem

Experience the synergy of mathematically rigorous indicators, where each component enhances the others to create a comprehensive trading system.

"Where legend meets logic, mathematical poetry transforms markets into opportunity."

The Integrated Ecosystem

Unlike standalone indicators, GYTS components communicate and enhance each other—creating an adaptive trading intelligence that evolves with market conditions.

Hover over components to see details. Lines indicate data flow between components.

Suite Components

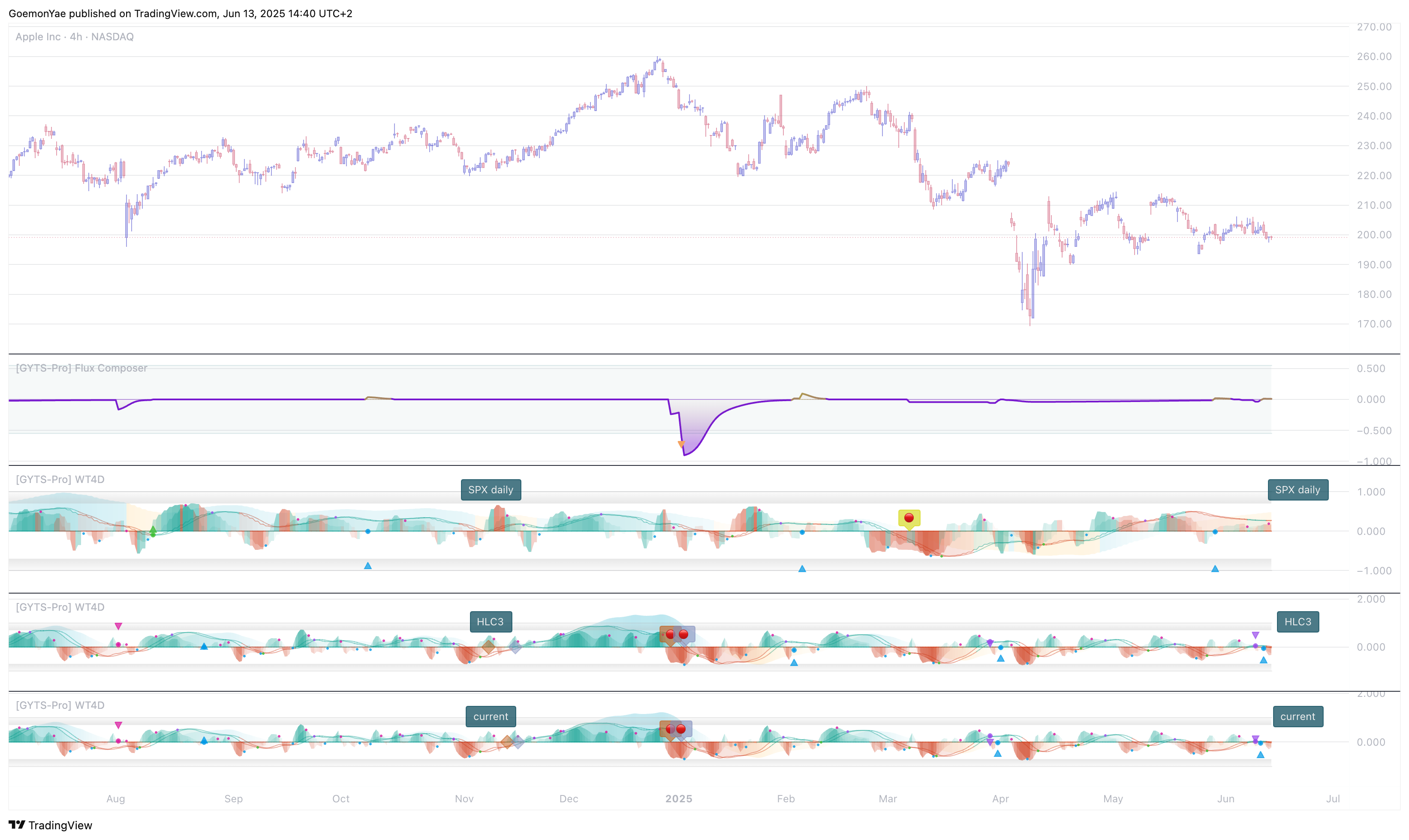

Signal Provider | WaveTrend 4D

Four-dimensional momentum oscillator with proprietary GDM and QMC signal generation methodologies.

Like a prism revealing light's hidden spectrum, WaveTrend 4D decomposes market momentum across four temporal frequencies. Built upon John F. Ehlers' signal processing research and enhanced by J. Dehorty's multidimensional framework, it reveals momentum patterns invisible to single-frequency analysis through our Gradient Divergence Measure (GDM) and Quantile Median Crosses (QMC).

Key Features

- Four-frequency analysis: fast, normal, slow, and lethargic perspectives

- GDM quantifies divergence strength through six mathematical components

- QMC identifies trend exhaustion after significant movements

- Continuous strength signals integrate seamlessly with Flux Composer

[GYTS-CE] Signal Provider | WaveTrend 4D

- Four-dimensional oscillator with configurable frequencies

- Choice of GDM or QMC methodologies (separate indicators)

- Visual divergence indicators and multiple display modes

- Full compatibility with GYTS Flux Composer

Flux Composer

Signal aggregation hub that transforms multiple indicators into unified trading intelligence through temporal decay modeling.

The Flux Composer orchestrates harmony from chaos, employing ensemble learning principles and advanced signal processing. It aggregates multiple signal streams through sophisticated temporal decay models and confluence mechanisms, transforming diverse market perspectives into actionable signals.

Key Features

- Aggregates up to 8 signal streams with intelligent temporal weighting

- Four confluence mechanisms including proprietary GYTSynthesis

- Adjustable intensity and decay for precise signal control

- Professional Edition enables dual-layer filtering for enhanced reliability

[GYTS-CE] Flux Composer

- Support for 2x GDM and 2x QMC signal streams

- Two confluence mechanisms: Amplitude Compression and Trigonometric

- Customisable decay functions with visual representation

- Trading signals via threshold crossings with alert compatibility

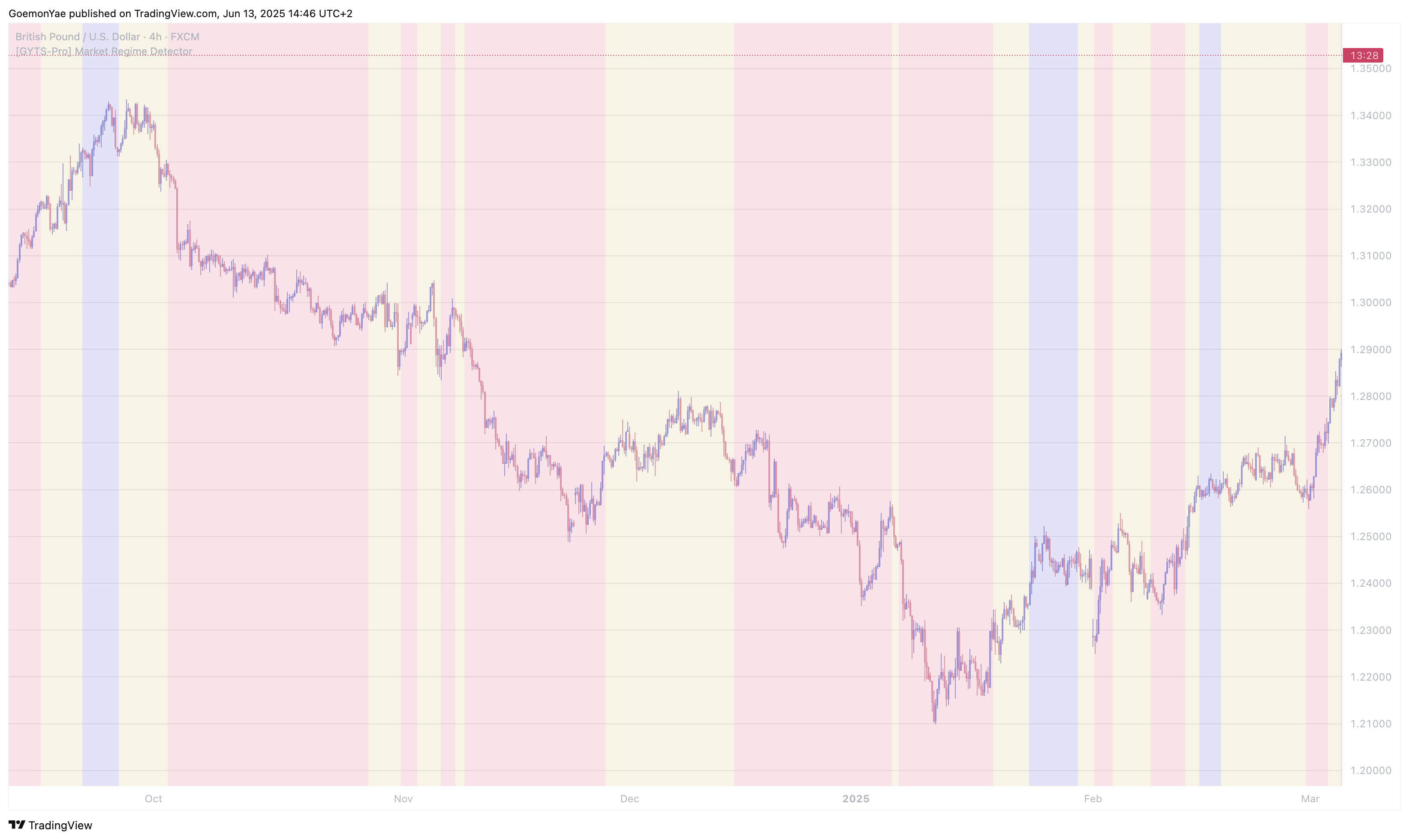

Market Regime Detector

Consensus-based market state identification using multiple detection methodologies to adapt strategies to current conditions.

Like a meteorologist reading atmospheric patterns, the Market Regime Detector interprets market climate through multiple sensing methodologies. Built on multiple orthogonal detection algorithms that vote on market state—ensuring strategies adapt to the market's true character rather than imposing rigid frameworks upon fluid dynamics.

Key Features

- Consensus-based detection using complementary methodologies

- Intuitive controls: Adaptability, Sensitivity, and Consensus modes

- Visual market feedback through colour-coded overlays

- Direct integration with Order Orchestrator for adaptive strategies

[GYTS-CE] Market Regime Detector

- Two detection methods: DCA and Volatility Channel

- Manual dominant cycle input with three consensus modes

- Visual regime feedback and TradingView alert compatibility

- Direct integration with Order Orchestrator

Order Orchestrator

Comprehensive execution framework that transforms signals into precise trading actions with adaptive position management.

The Order Orchestrator bridges insight and implementation, enabling construction of adaptive trading systems that respond dynamically to market conditions. From multi-level profit targets to position sizing algorithms inspired by mathematical game theory, it transforms theoretical signals into practical execution.

Key Features

- Multi-signal integration with up to 5 independent sources

- Dynamic take profit system with 5 customisable levels

- Adaptive position sizing using martingale mathematics

- Market regime filtering and third-party platform integration

[GYTS-CE] Order Orchestrator

- Essential backtesting with visual trade tracking

- Signal integration from up to 3 GYTS sources

- Standard position sizing with basic risk controls

- Core profit/loss management with regime awareness

- Alert system for notifications and third-party integration

[GYTS-Pro] Order Orchestrator

- Integration with up to 5 signal sources and sophisticated mapping

- Multi-level take profit system with percentage-based allocation

- Advanced adaptive position sizing with customisable progression

- SuperTrend exit system with dynamic trailing stops

- Third-party integration via PineConnector and API webhooks

- Comprehensive visualisation for intuitive trade monitoring

SuperTrend

Advanced trailing stop methodology. Launching Q3 2025.

Need Help?

Find answers, explore documentation, or take action